St. Paul, MN (December 28, 2015) — Matsuura Machinery USA, Inc. encourages customers to take advantage of the Section 179 and Bonus Depreciation Exceptions recently passed by Congress.

The Protecting Americans from Tax Hikes Act of 2015 was passed by Congress last week and includes several key provisions for tax payers and small businesses. Congress cleared up uncertainty over the Section 179 and Bonus Depreciation tax breaks, not only retroactively for 2015 but also for the next several years.

A permanent extension of higher Section 179 limits was approved and is excellent news for Matsuura USA customers.

“From 2010 to 2014, the small business expensing limitation and phase-out amounts were $500,000 and $2 million, respectfully; however, on January 1st, 2015 those levels dropped to $25,000 and $200,000. The new rules increase the limits to $500,000 and $2 million, and beginning in 2016 those levels would be indexed to inflation,” said Chris Richardson of Manufacturers Capital, Matsuura USA’s preferred financial resource.

The new Bill also extends bonus depreciation for property acquired and placed into service during 2015 through 2019.

“The Bonus amount is proposed to be set at 50% for 2015 – 2017, and phased out at 40% and 30% for 2018 and 2019, respectfully. This is not only great news for businesses who made purchases this year, but will remove unnecessary uncertainty over the next several years and hopefully spur companies to make more capital purchases,” Richardson added.

The Section 179 Deduction allows a machine tool buyer to deduct the first $500,000 from their taxable income for up to the phase out cap of $2,000,000. For amounts over this $2,000,000 phase out cap, there is a dollar for dollar deduction of this Section 179 allowance. This Section 179 is applicable to new or used equipment purchases.

The Act also schedules the Bonus Depreciation to 50%. This Bonus Depreciation will allow a deduction of half the remaining basis after the Section 179 Deduction is expensed. Bonus Depreciation is only allowed for new equipment purchases.

The Section 179 allows businesses that spend less than $2,000,000 a year on qualified equipment to write-off up to $500,000 in 2015. For 2016 and beyond the Section 179 Deduction will be indexed annually each year for inflation.

In addition to the 179 Deduction the remaining balance not written off then qualifies for an additional write off of HALF (50%) of the remaining balance in 2015 through 2017 with phase out provisions of 40% and 30% in 2018 and 2019, respectively.

Companies can then deduct their Standard Depreciation (usually over 7 years) on the adjusted basis after the Section 179 Deduction and Bonus Depreciation deduction.

These deductions apply to equipment placed in service on or before December 31, 2015. Section 179 Deductions apply to new or used equipment, but the Bonus Depreciation only applies to new machinery.

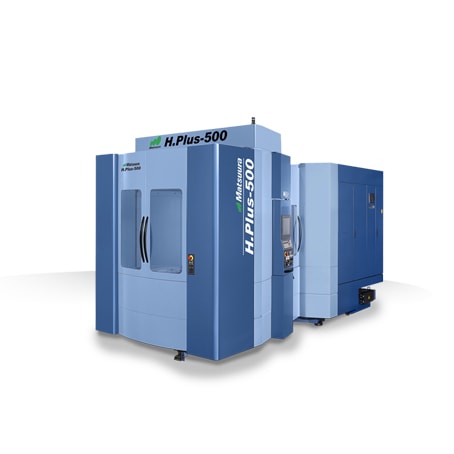

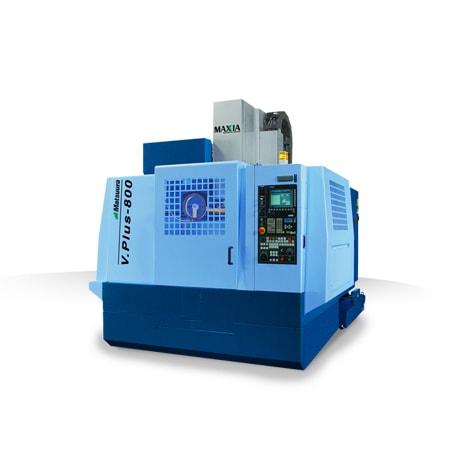

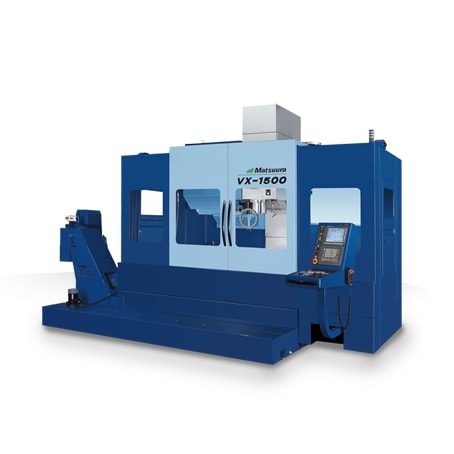

“Now is the perfect time to purchase a technologically-advanced Matsuura machine tool and gain a competitive advantage over your competitors and enhance your profits,” said a Matsuura USA Spokesperson.

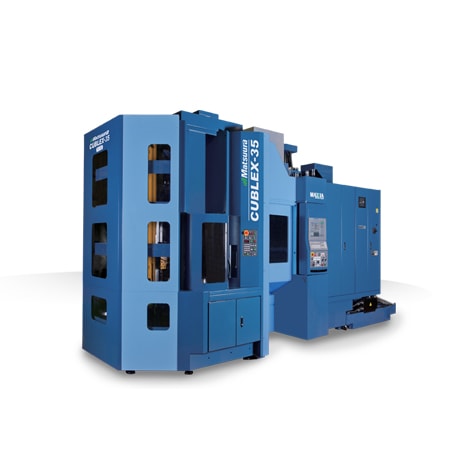

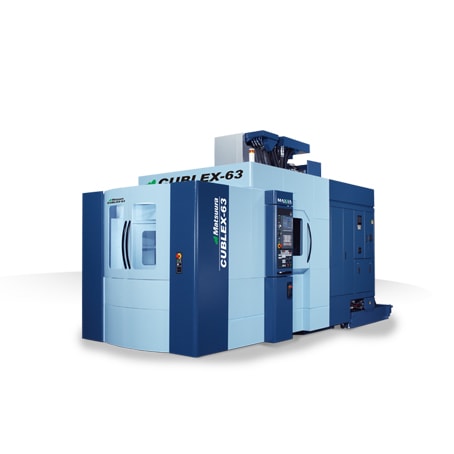

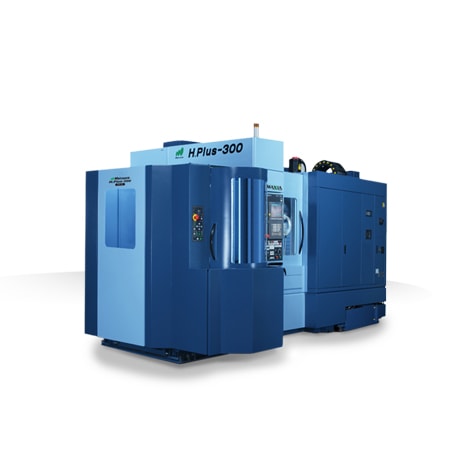

Matsuura Machinery USA, located in St. Paul, MN is the master importer of Matsuura machining centers in the United States. Matsuura delivers unmatched excellence in high speed and high precision CNC machine tools. The company’s unmanned, high accuracy machining equipment, including multi-pallet and multi-tasking machine tools provide manufacturing solutions to a variety of industries around the globe.

The company’s 40,000 sq. ft. facility includes a large showroom and demonstration area, conference and training rooms, machine storage areas, accessories and spare parts, as well as administrative, service, and engineering application support.

Matsuura Machinery USA professionally markets and supports Matsuura equipment users through local distributors. Since 1935, Matsuura has been a leader in developing and manufacturing innovative machining equipment to ensure that manufacturing professionals always have the tools they need to create high quality parts. As the U.S. subsidiary of Matsuura Machinery Corporation in Japan, Matsuura USA provides the premium service, applications, and technical field support that have always been the Matsuura standard for business.

For more information on Matsuura products, contact:

Matsuura Machinery USA, Inc.

325 Randolph Avenue

St. Paul, MN 55102

651-289-9700

[email protected]

www.www.matsuurausa.com

For more information, please contact our preferred financial resource

Manufacturers Capital

Chris Richardson

Direct: 317-695-3000

Email: [email protected]