St. Paul, MN (June 17, 2016) — Matsuura Machinery USA, Inc. encourages customers to take advantage of the Section 179 and Bonus Depreciation Exceptions.

“With savings of 20 to 40% on machine purchase, the Protecting Americans from Tax Hikes Act includes several key provisions for taxpayers and small businesses” said Matsuura Machinery USA, Inc. VP Finance and Administration, Brad Baker.

This increase encourages the purchase of new equipment, where companies can write off up to $500,000 within the very first year alone. Along with the traditional bonus and normal depreciation, savings are abundant.

“Purchasing new equipment and saving money is straightforward and simple. Since the government has increased the 179 tax deduction—tax savings are essentially feasible for everyone,” Baker added.

The Section 179 Deduction allows a machine tool buyer to deduct the first $500,000 from their taxable income for up to the phase out cap of $2,000,000. For amounts over this $2,000,000 phase out cap, there is a dollar for dollar deduction of this Section 179 allowance. The Act also schedules the Bonus Depreciation to 50%. This Bonus Depreciation will allow a deduction of half the remaining basis after the Section 179 Deduction is expensed. Bonus Depreciation is only allowed for new equipment purchases.

Companies can then deduct their Standard Depreciation (usually over 7 years) on the adjusted basis after the Section 179 Deduction and Bonus Depreciation deduction. Section 179 Deductions apply to new or used equipment, but the Bonus Depreciation only applies to new machinery.

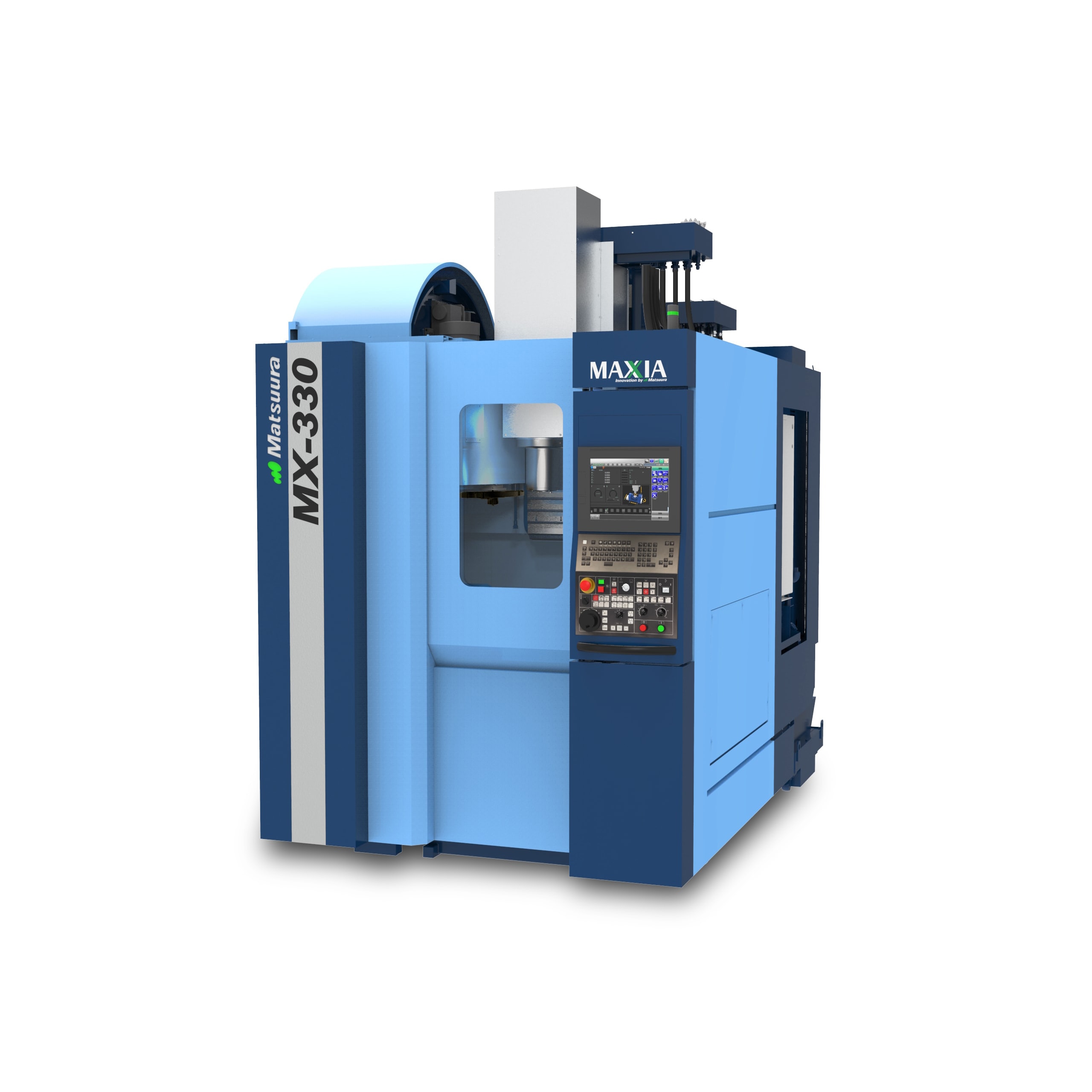

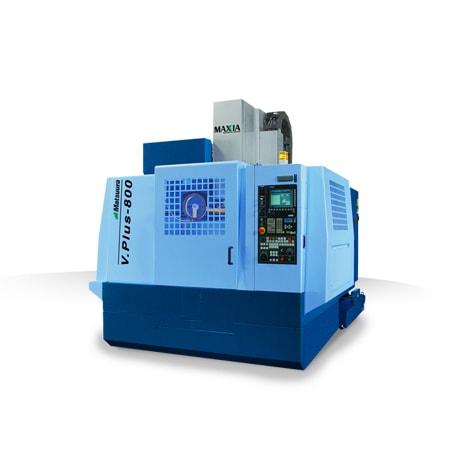

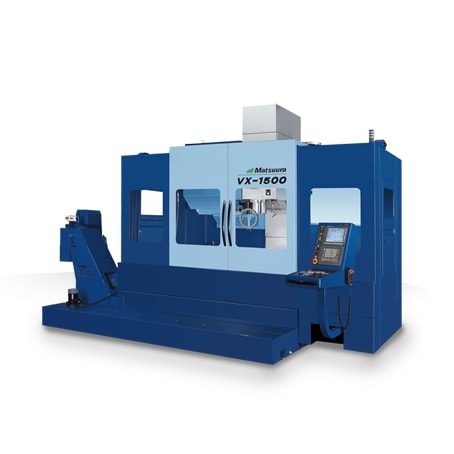

“These tax savings will lower your cost of ownership. Now is the perfect time to purchase a technologically-advanced Matsuura machine tool, gain a competitive advantage and enhance your profits,” Baker concluded.

Learn how Matsuura can assist your shop in manufacturing higher quality parts faster, more efficiently and at a lower cost. Please contact your exclusive Matsuura distributor or visit: MatsuuraUSA.com.

Disclaimer: Matsuura Machinery USA, Inc. and its owners, affiliates, distributors and partners are not tax advisors. Please consult with qualified professionals concerning your specific situation.

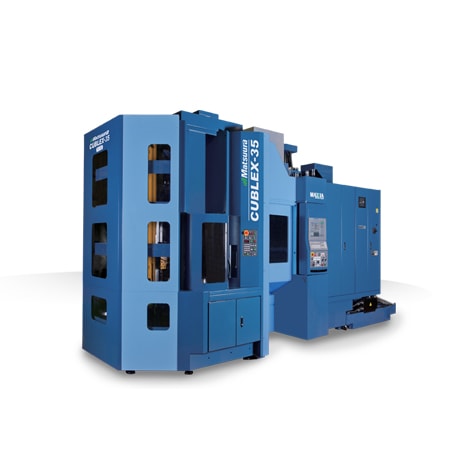

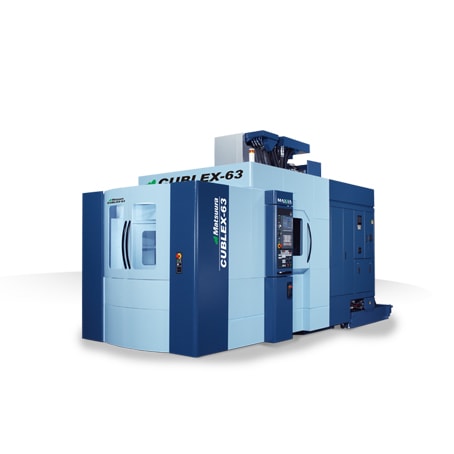

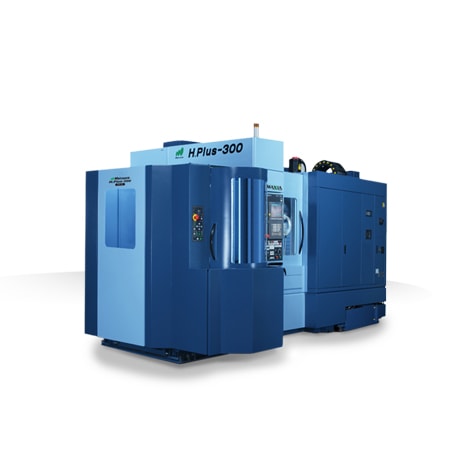

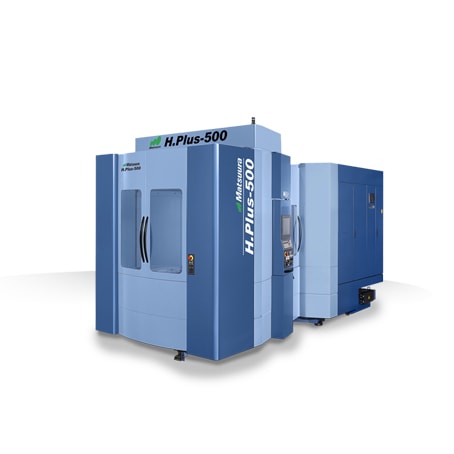

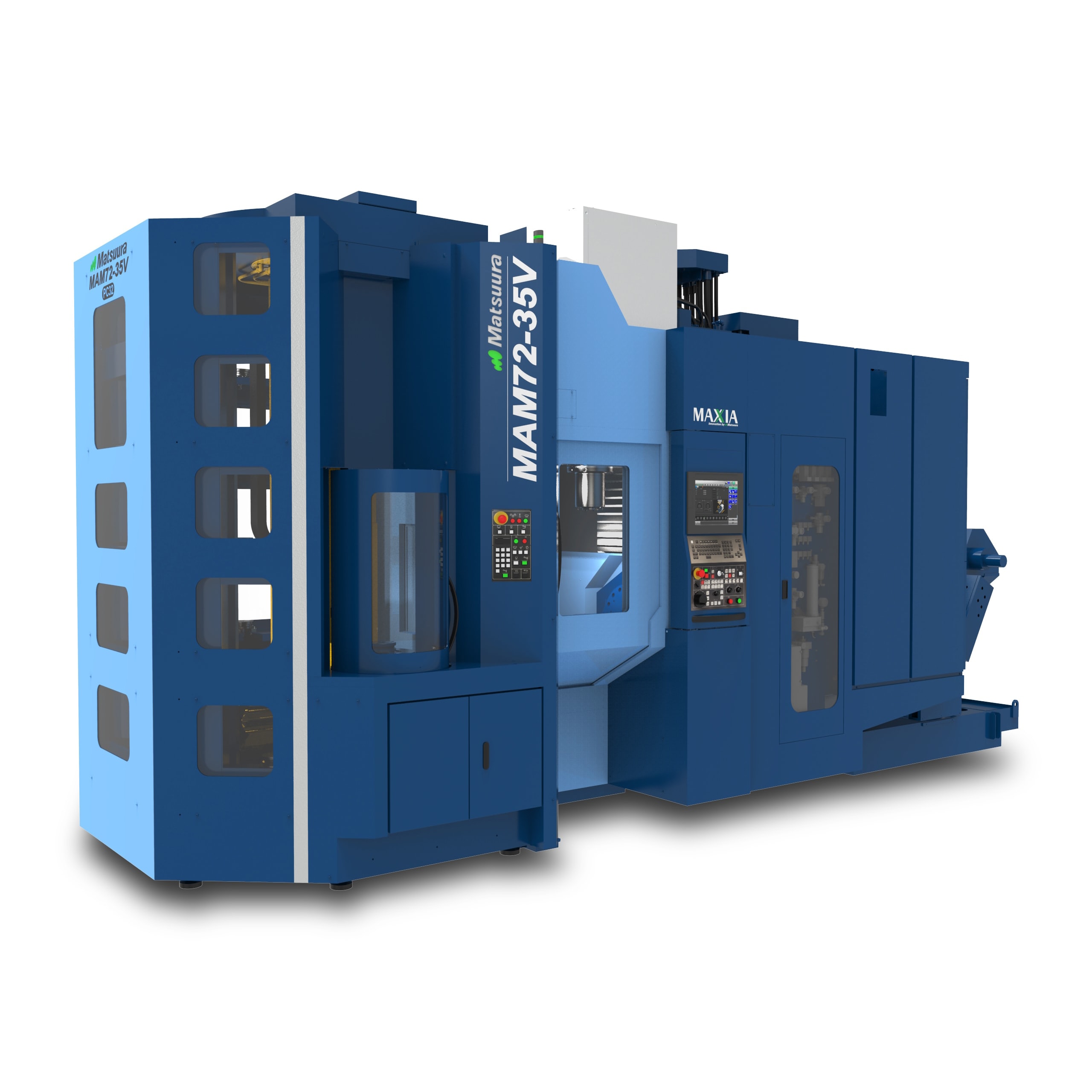

Matsuura Machinery USA, located in St. Paul, MN is the importer of Matsuura machining centers in the United States. Matsuura delivers unmatched excellence in high speed and high precision CNC machine tools. The company’s unmanned, high accuracy machining equipment, including multi-pallet and multi-tasking machine tools provide manufacturing solutions to a variety of industries around the globe.

The company’s 40,000 sq. ft. facility includes a large showroom and demonstration area, conference and training rooms, machine storage areas, accessories and spare parts, as well as administrative, service, and engineering application support.

Matsuura Machinery USA professionally markets and supports Matsuura equipment users through local distributors. Since 1935, Matsuura has been a leader in developing and manufacturing innovative machining equipment to ensure that manufacturing professionals always have the tools they need to create high quality parts. As the U.S. subsidiary of Matsuura Machinery Corporation in Japan, Matsuura USA provides the premium service, applications, and technical field support that have always been the Matsuura standard for business.

For more information on Matsuura products, contact:

Matsuura Machinery USA, Inc.

325 Randolph Avenue

St. Paul, MN 55102

651-289-9700

[email protected]

www.matsuurausa.com