St. Paul, MN (September 20, 2019) — The US Federal Reserve announced that U.S. industrial production rose in August, a welcome sign of resilience in the economy after recent weak readings.

Industrial production, a measure of factory, mining and utility output, rose a seasonally adjusted 0.6% in August from the prior month, well above economists’ expectations for a 0.2% increase.

“This sector cannot be considered strong, but damage from slow growth abroad and trade tensions has not been severe so far,” Daiwa Capital Markets economist Michael Moran said in a note to clients.

The stronger-than-expected report on factory output comes as Federal Reserve officials meet in Washington for a two-day policy gathering. Fed Chairman Jerome Powell is leading his colleagues to cut interest rates by a quarter percentage point at their meeting, for the second time in as many months, to cushion the U.S. economy against a slowdown from the U.S.-China trade conflict and weak growth abroad.

According to the Wall Street Journal, Tuesday’s report runs counter to earlier signs of weakness in the industrial sector. Output at U.S. factories, which accounts for about 75% of the nation’s total industrial output, rose 0.5% last month from July.

Jay Teeters, office manager at 310 Tempering LLC, said construction projects have boosted demand for the Louisville, Ky.-based maker of railings and shower doors. The company, which has around 60 employees, is looking to hire a few more, Mr. Teeters said.

“A lot of things are booming right now,” he said. “Hotels are going up, projects are going up, businesses are renovating.”

Factory output has increased an average of 0.2% a month over the past four months, after declining an average of 0.5% a month during the first four months of the year, the Fed said. Still, from a year earlier, industrial production rose by a tepid 0.4% in August, while manufacturing declined by 0.4%.

Tuesday’s report showed the mining index, which includes oil and natural gas extraction, increased 1.4% in August, after declining 1.5% in July as Hurricane Barry hit oil rigs in the Gulf of Mexico. Output in the volatile mining sector was up 5.1% from a year earlier. Utility production increased 0.6% from July.

Hiring and consumer spending haven’t lost significant momentum, suggesting domestic growth remains solid, though exports and business investment weakened in the second quarter as companies struggled with uncertainty surrounding the trade strife.

Elsewhere in the U.S. industrial sector, the Institute for Supply Management’s manufacturing index fell to 49.1 in August from 51.2 in July, signaling a likely contraction in manufacturing activity. That led some economists to question whether Tuesday’s report signaled an aberration from the broadly downbeat trend.

“Pretty much every bit of evidence points in that direction except for this one number,” said MFR Inc. economist Joshua Shapiro, who added that “when you look at what manufacturers are saying, doesn’t really jibe.”

Though manufacturing accounts for a small share of gross domestic product, the sector is highly sensitive to shifts in global demand, making it a bellwether for the broader U.S. economy.

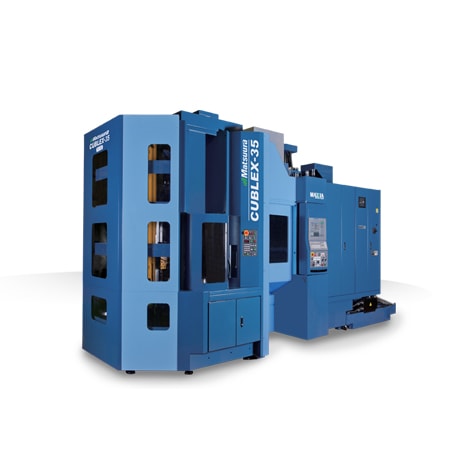

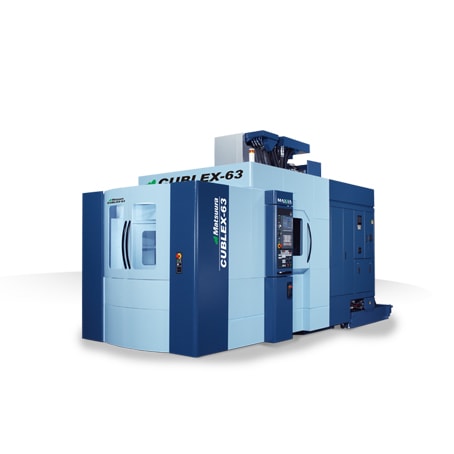

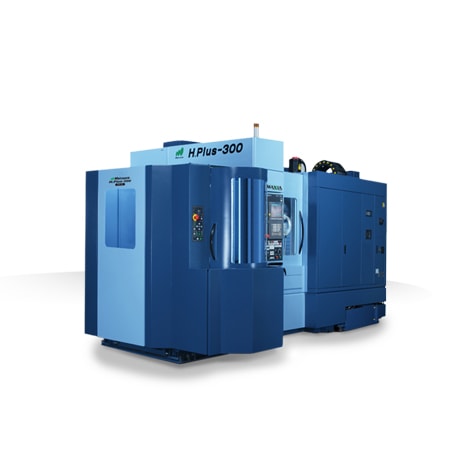

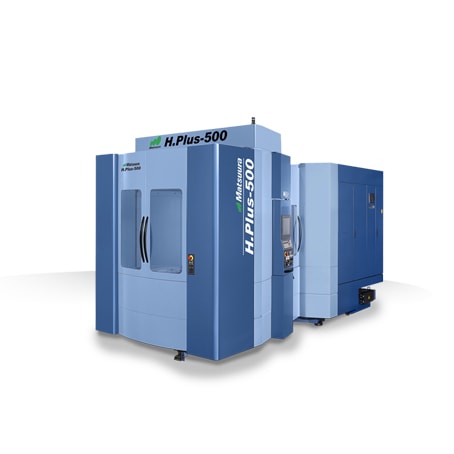

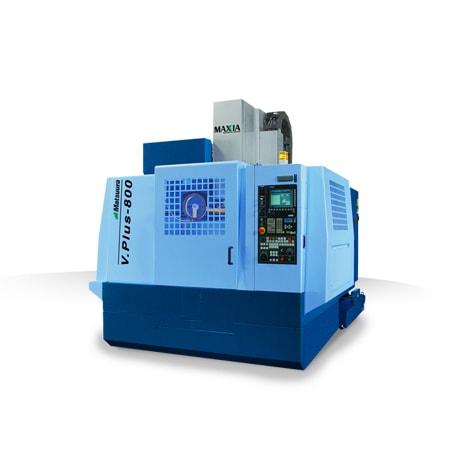

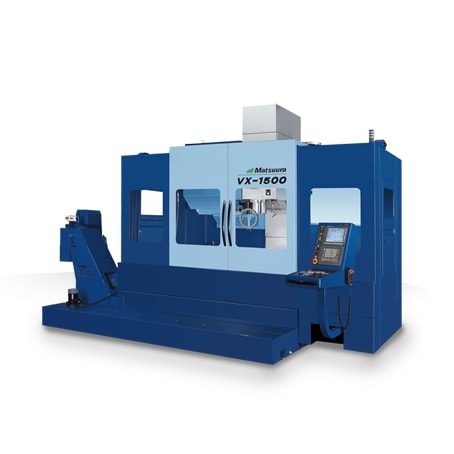

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. delivers unmatched excellence in 5-axis, vertical, horizontal, linear motor, multi-tasking CNC machine tools and machines with a powder bed metal AM platform with machining capability.

Matsuura Machinery USA, Inc. provides the service, applications and technical field support that have always been the Matsuura standard for business. For more information on Matsuura products, contact: [email protected] or visit: www.matsuurausa.com.