St. Paul, MN (March 22, 2018) — According to @advancedmanufacturing.org, January US cutting tool consumption totaled $183.61 million, according to the US Cutting Tool Institute (USCTI) and AMT—The Association for Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 4.9% from December’s $175.00 million and up 6.1% when compared with the $173.05 million reported for January 2017. With a year-to-date total of $183.61 million, 2018 is up 6.1% when compared with 2017.

“The boom in domestic and global manufacturing has continued to show positive growth for the cutting tool industry,” said Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “This is causing increasing pressure on cutting tool capacity and raw material sourcing, but these are good problems and are welcomed by the industry.”

Eli Lustgarten, president at ESL Consultants, said, “Demand for cutting tools in January 2018 continued to demonstrate the ongoing improvement in manufacturing activity that continued throughout 2017. Sales increased 4.9% month over month in January and rose 6.1% over the same period a year ago, supporting our belief that the industrial sector will continue to strengthen as the year progresses. The US February ISM Manufacturing Index rose to 60.8 compared to 59.1 in January and 59.3 in December 2017. This was the best level since 2004 and the third highest since 1985. New orders and production remain at very strong levels, building a backlog and pointing toward rising industrial production and higher capacity utilization as the year progresses. With an improving global backdrop, the cutting tool sector is headed toward another banner year with sales gain approaching if not exceeding 10%.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on US manufacturers’ consumption of the primary consumable in the manufacturing process—the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology. Thank you to @advancedmanufacturing.org for this data.

According to Marketwatch.com and SandlerResearch.org, the machining center market will surpass $5 Billion by 2020.

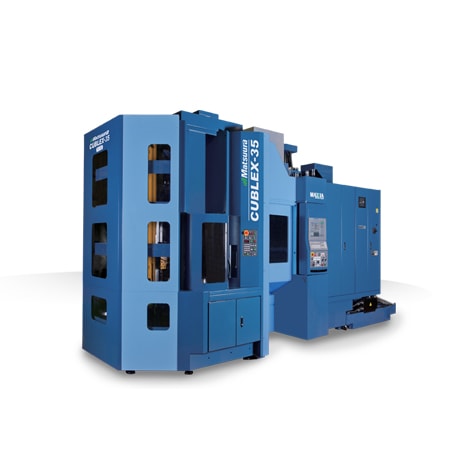

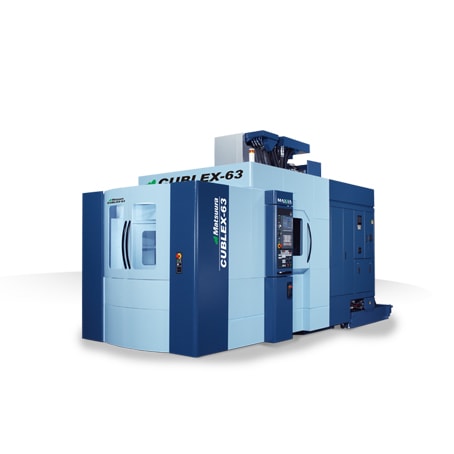

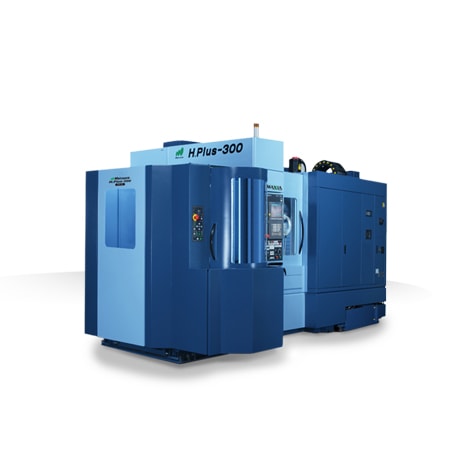

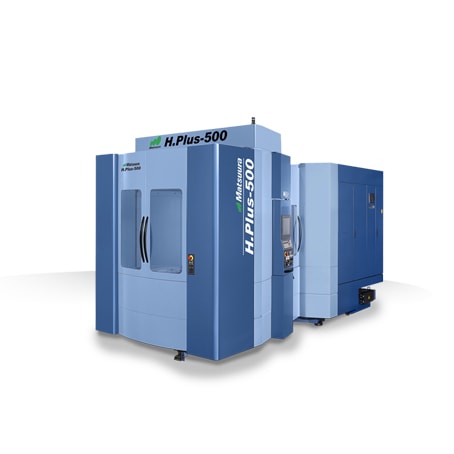

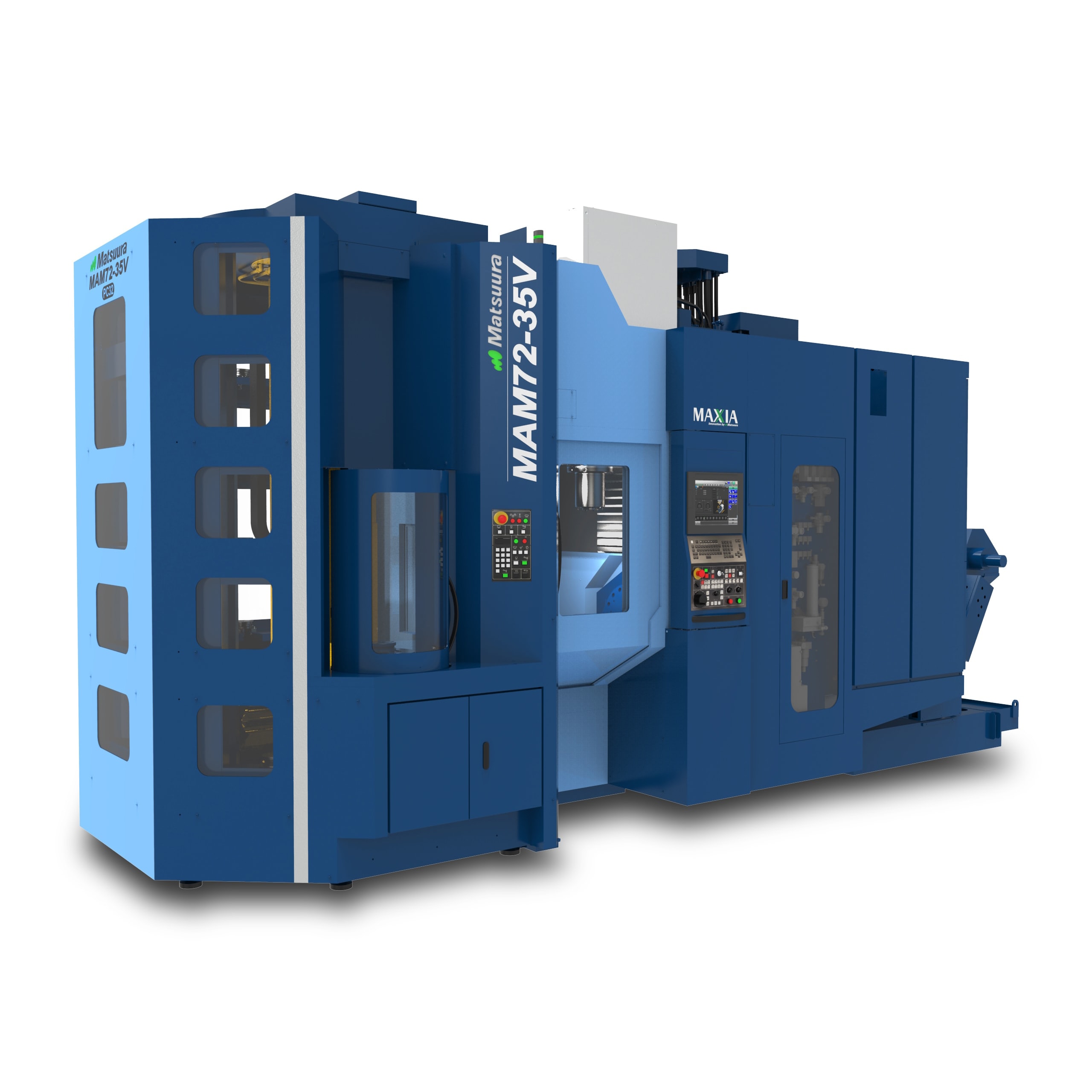

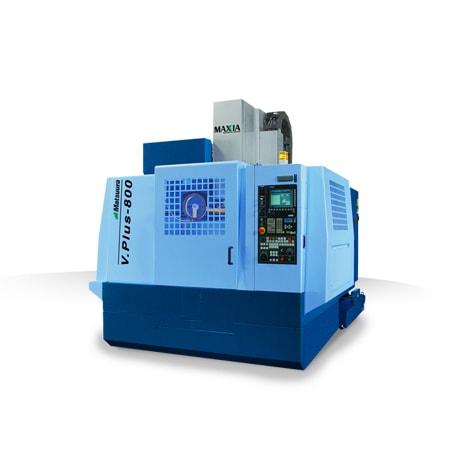

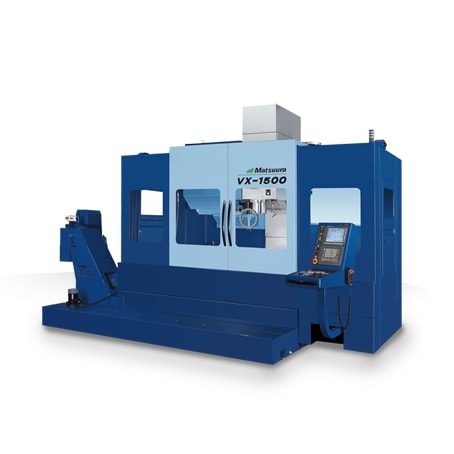

As manufacturing in North America becomes more complex, requiring multi-axis machining solutions, Matsuura is the preeminent solutions provider. While most industries maintain a higher part mix and smaller batch production, reduction of inventory is an imperative initiative. Additionally, with pressure on pricing and margins, customers realize they must discover methods to reduce labor costs.

The analysts forecast global machining center market to grow at a CAGR of 5.68% during the period 2016-2020. According to the machining center market report, growing demand for fabricated metal products will be a key driver for market growth. The global fabricated metal products market was valued at $1.81 trillion in 2015 and will likely reach $2.35 trillion by 2020, growing at a CAGR of 5.36%. The US accounted for almost 20% of the entire global fabrication metal product market. There is an increase in the demand for US-manufactured fabricated metal products worldwide. For example, Mexico, Canada, and China rely heavily on the US for the supply of fabricated metals. Increased fabricated metal production in the country is leading to rising domestic demand for machine tools.

According to machining center market research and analysis, the automotive industry accounted for more than 41% of the total market shares and dominated the industry during 2015. This industry uses machining centers in various metal processing operations like cutting, drilling, and surface cleaning of the metal sheets used in the fabrication of automotive parts. The expected growth of the automotive industry all over the world, especially in the emerging markets will bolster the market’s growth prospects in the coming years.

Matsuura is a key player in the global machining centers market. Matsuura Machinery’s exclusive distributor network works alongside Matsuura to define the ideal manufacturing method and oversee the complete project – from concept to production, from training to after sales technical and service support.

To discover how Matsuura’s advanced technology can provide a competitive advantage by acquiring engineering solutions for your manufacturing challenges; contact your exclusive Matsuura distributor or contact Matsuura USA at [email protected].

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Since 1935, Matsuura has been the forerunner in designing innovative technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. delivers unmatched excellence in 5-axis, vertical, horizontal, linear motor, multi-tasking CNC machine tools and machines with a powder bed metal AM platform with machining capability. Matsuura Machinery USA, Inc. provides the service, applications and technical field support that have always been the Matsuura standard for business. For more information on Matsuura products, contact: [email protected] or visit: www.matsuurausa.com.