Don’t leave money on the table! The 2023 Section 179 Tax Deduction is more important than ever and can impact your bottom line.

Section 179 can be used on eligible equipment bought and put into service during the calendar year. This means you have until midnight of December 31 to use it for 2023.

Section 179 is the provision of the U.S. Tax Code that allows companies to fully accelerate the depreciation of equipment to the year you buy it and put it in service.

Using this deduction, you can deduct/write off 100% of the purchase price of nearly all tangible equipment you buy from your taxable income.

Section 179 has a 2023 deduction limit of $1,160,000, with a total equipment spend of $2,890,000. Once the $2.89 million number is reached, the deduction is reduced on a dollar-for-dollar basis. Most companies will not reach that limit, which is why Section 179 is viewed as a great deduction.

Matsuura’s Section 179 Calculator

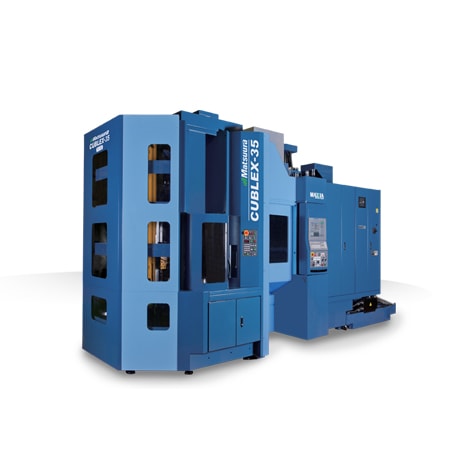

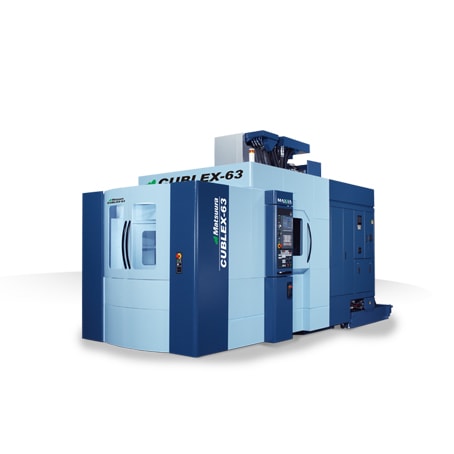

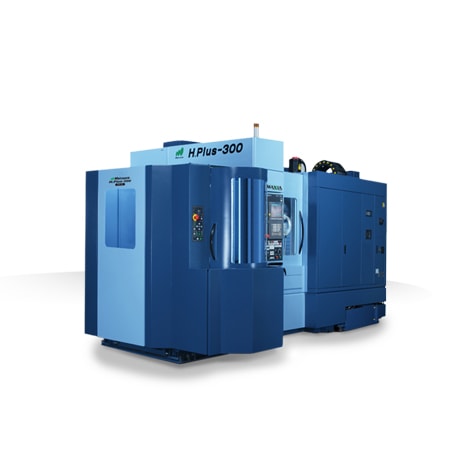

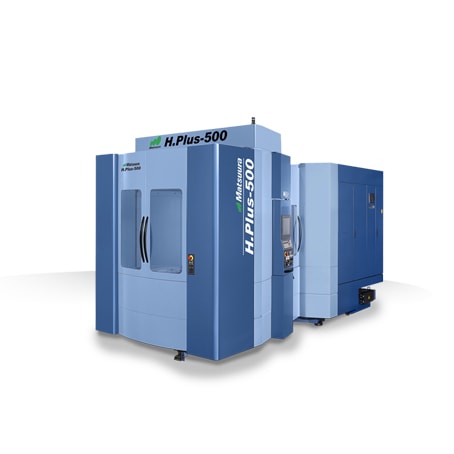

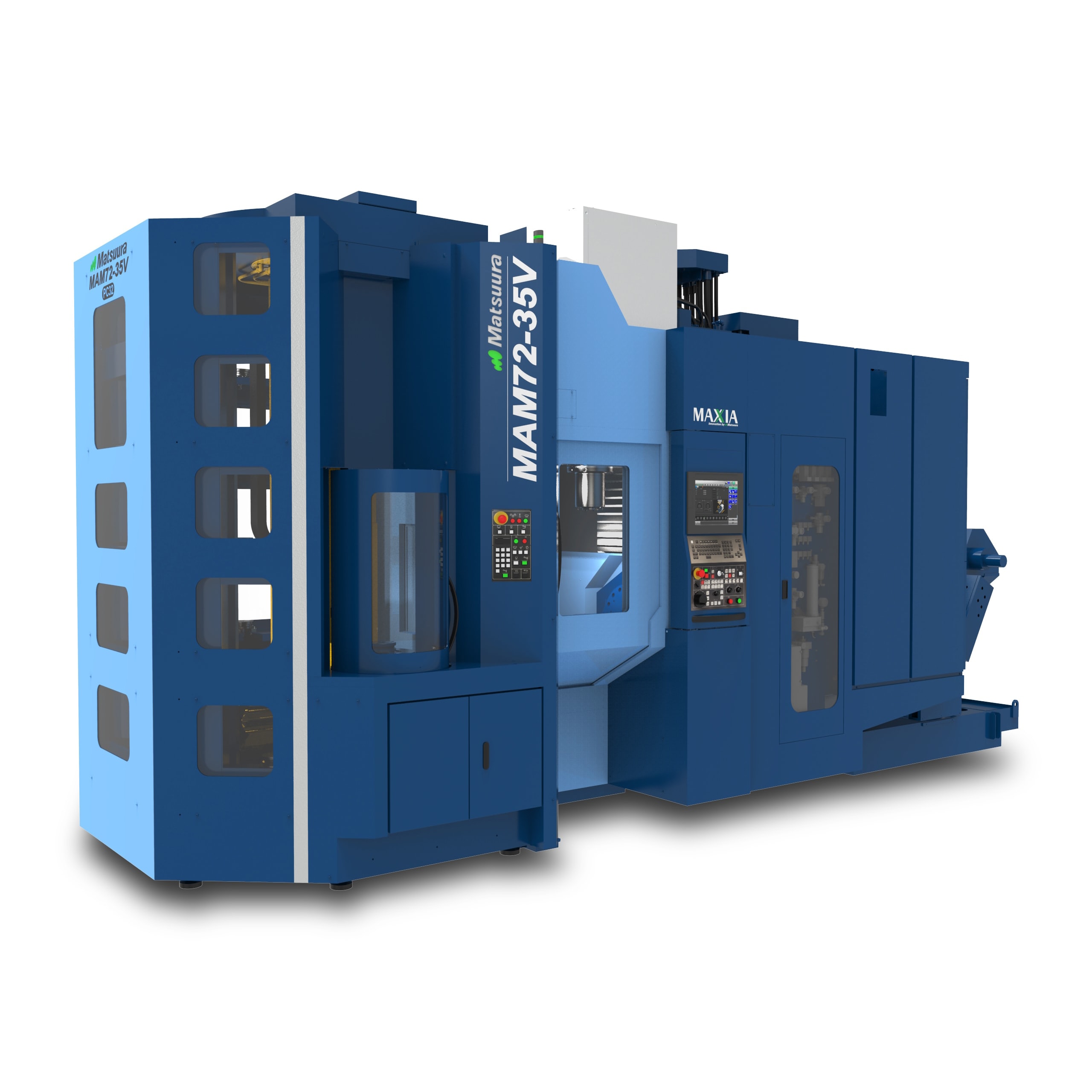

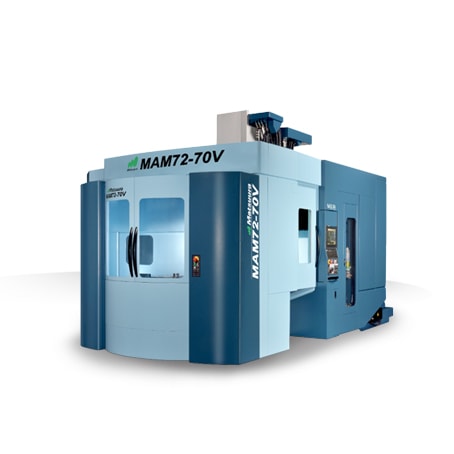

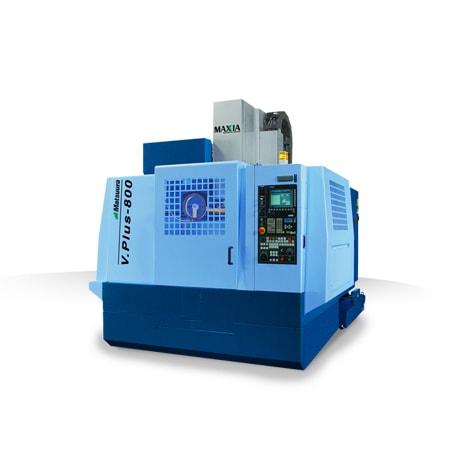

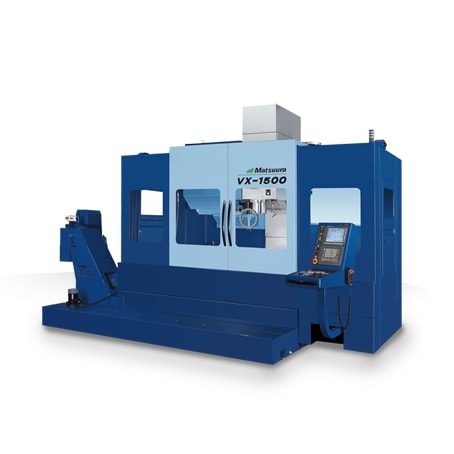

Now is the time to invest in the pinnacle of production, the technologically advanced MAM72 Series of machines. Discover the benefits of Matsuura’s larger palletized machining!

For a limited time, receive special pricing and promotions on Matsuura’s MAM72-52V, MAM72-70V, & MAM72-100H. Machines are in stock & ready to ship-while supplies last!

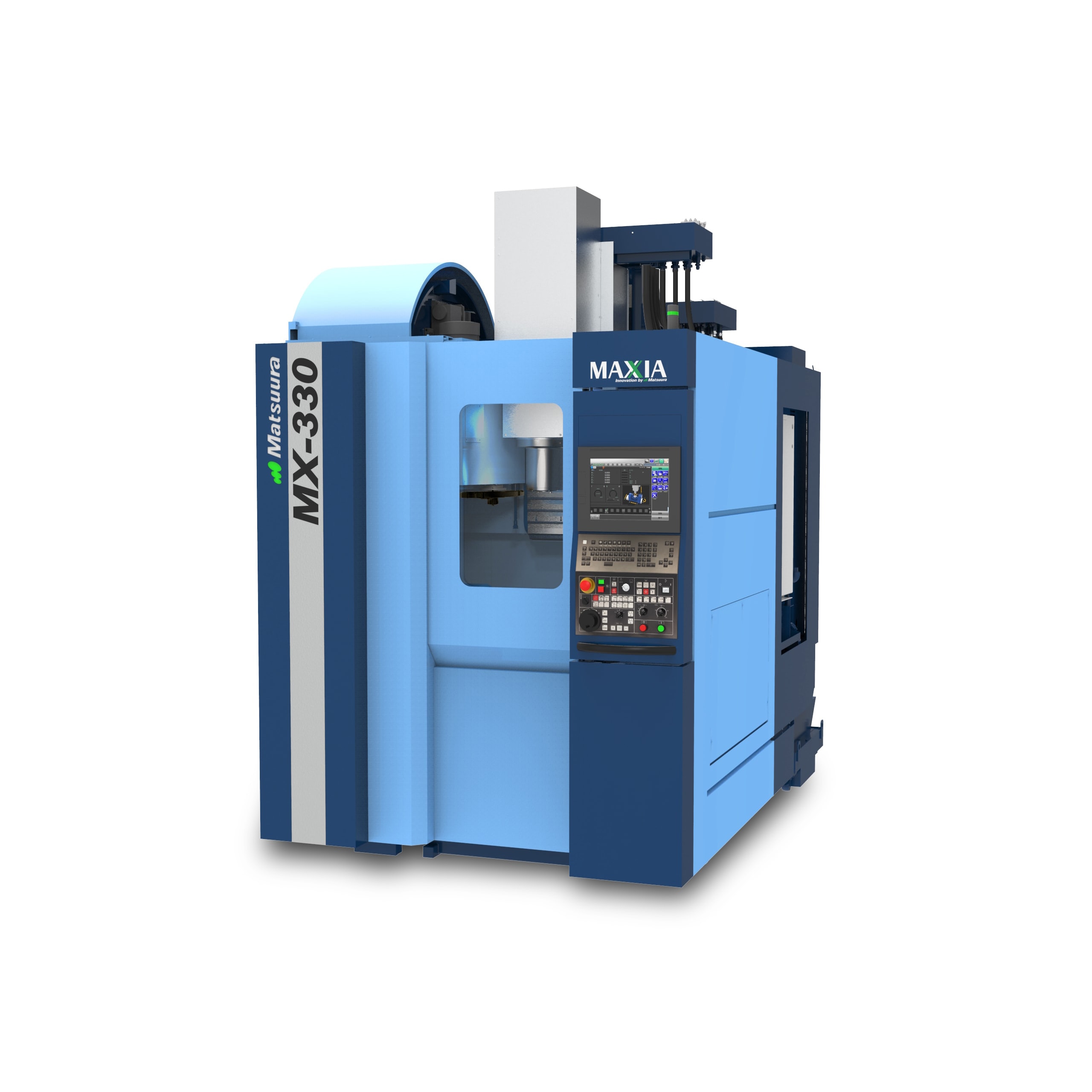

Experience the ROI of Lights-Out Manufacturing. Matsuura’s 5-axis unmanned automation solutions expand production and increase profit, while improving efficiency & utilizing nighttime hours.

Contact your exclusive Matsuura Distributor or email Matsuura: [email protected] for special pricing information. Machines are IN STOCK and ready to ship.

Don’t miss this extraordinary sales event and take advantage of the 2023 Section 179 Tax Incentives.