St. Paul, MN (November 4, 2020) – The Gardner Business Index (GBI) reported an accelerating expansion in business activity for October 2020 with a 53.9 reading. Removing the inflationary effect of sluggish supplier deliveries, the Index delivered an encouraging reading of 52.4 and still above the comparable September reading of 50.1., according to Steve Kline, Chief Data Officer.

October’s results marked a very significant and positive milestone for manufacturing, small-shops (20-employees or fewer) reported for the first time in 2020 that overall business conditions expanded in the month-to-month period.

The Gardner Business Index (GBI) reported an accelerating expansion in business activity for October 2020 with a 53.9 reading. Removing the inflationary effect of sluggish supplier deliveries, the Index delivered a still encouraging reading of 52.4 and still above the comparable September reading of 50.1. Readings above a level of 50 indicate expanding business activity. The further a reading is above 50 the more broadly that change in business activity is being observed as compared to the prior month.

October’s advancement was made possible by a 4-point increase in production and 3-point increase in new orders. Employment activity also registered accelerating expansion in addition to setting a 2-year high reading. GBI states that as we approach the end of the year and the typical seasonal rise in consumer sales, it may not be particularly surprising that supplier delivery readings are rising (indicating lengthening delivery times) after reporting an improvement in delivery speeds in previous months. Only backlogs and export orders activity continue to report slowing contractionary readings with backlogs very near a reading of 50 or ‘no-change’.

To find a comparable time when the same proportion of small businesses reported improving conditions one would have to go back to February 2019. The expansion among small business was in large part attributable to expanding new orders and production activity; however, when adjusted for slowing supplier deliveries, the monthly overall reading would have been very slightly contractionary. Firms of all other sizes reported expanding activity in October both with and without the support of supplier delivery readings. Among all size categories, firms of between 100 and 250 employees have expanded significantly faster than all other sizes since August.

An examination of October’s data by end-market indicated a significant acceleration in electronics manufacturing which expanded faster than any other major end-market monitored. It was followed by expanding activity in the forming and fabricating, custom processors and automotive industries. Another important development reported by the end-market data was the transition of the Metalworking Job Shops market into expansionary territory for the first time under COVID’s shadow. Only the aerospace, industrial motors and construction machinery markets reported accelerating contractionary activity in October.

More from Mr. Kline and Gardner Intelligence at: https://www.gardnerintelligence.com/

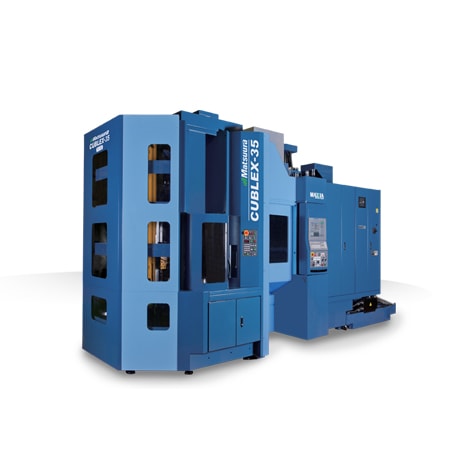

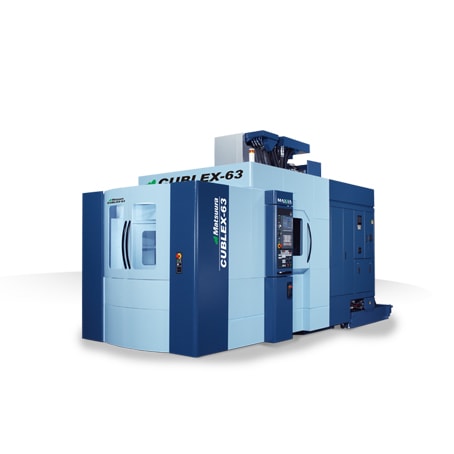

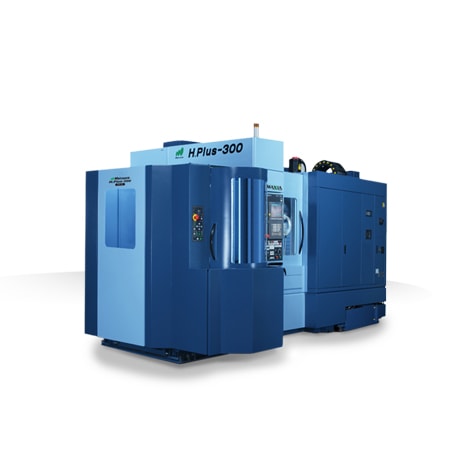

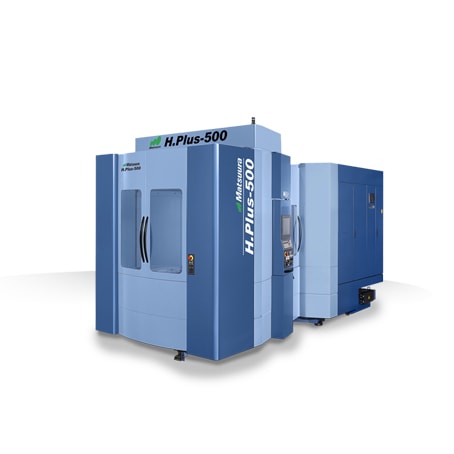

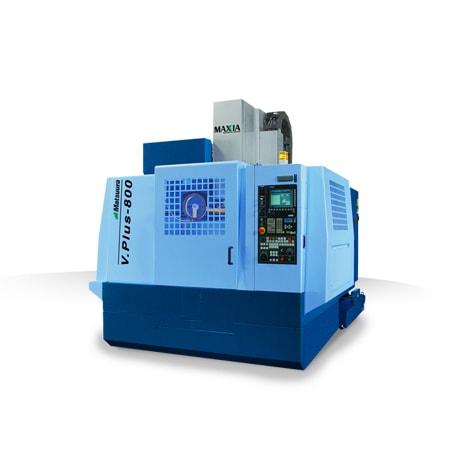

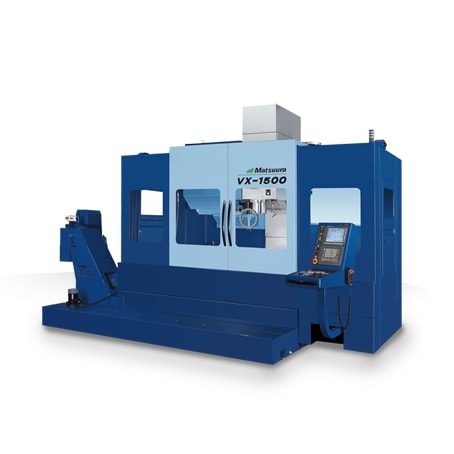

Matsuura Machinery USA, Inc., located in St. Paul, MN is the U.S. subsidiary of Matsuura Machinery Corporation in Japan. Matsuura, an innovator in the design, development and manufacture of high-precision manufacturing solutions for more than 80 years, has been the forerunner in designing pioneering technology and manufacturing solutions to a variety of industries around the globe. Matsuura Machinery USA, Inc. delivers unmatched excellence in 5-axis, vertical, horizontal, linear motor, multi-tasking CNC machine tools and machines with a powder bed metal AM platform with machining capability. Matsuura Machinery USA, Inc. provides the service, applications and technical field support that have always been the Matsuura standard for business.

For more information about Matsuura, please contact: [email protected] or visit: matsuurausa.com.